Transaction volume in the Danish commercial real estate market lowest since 2014

EDC Poul Erik Bech has joined forces with 6 other leading commercial real estate agents in a new collaboration for a coordinated and unified transaction data for commercial and investment properties in Denmark to create transparency in the commercial real estate industry.

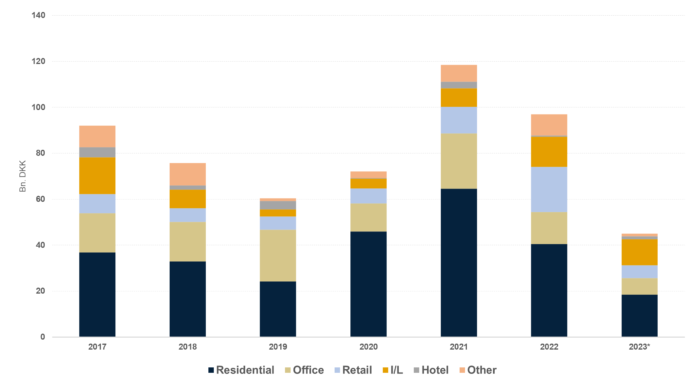

Historical development in transaction volume in Denmark

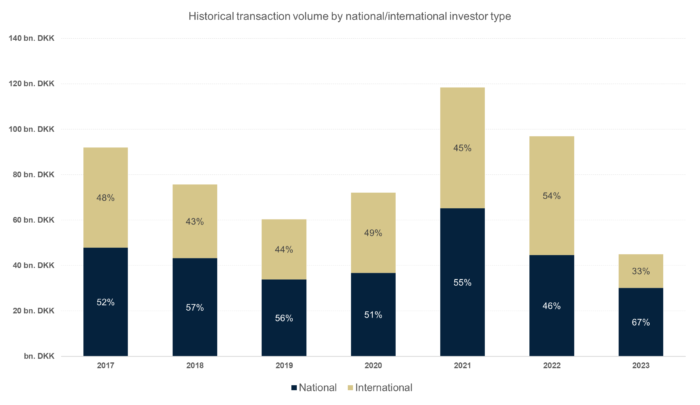

Capital takes up space – international takes up less space

Joseph Alberti, Head of Research, EDC Poul Erik Bech, says: “The total transaction volume in 2023 landed at DKK 45 billion, which is distributed with 41% residential, 25% industrial and logistics, office 16%, retail 13%, hotel 3% and other 2%. With such a significant drop, there is naturally a decline in all segments, but only a minor decrease in Industrial/Logistics, which continues to grow as a result of the aftermath of COVID-19 and supply chain issues in the market. We expect that there will continue to be positive winds for the segment in the future.”

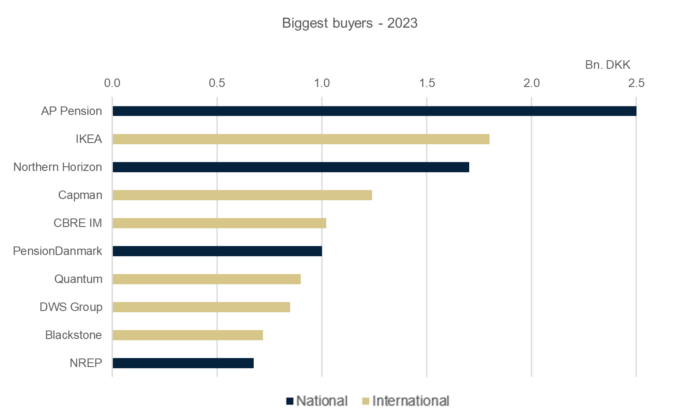

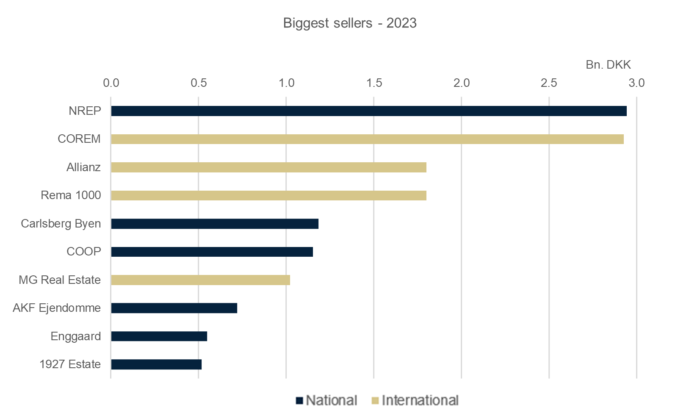

“At the same time, it is worth noting that the Capital Region accounts for half of all transactions. There has also been a shift in international transactions, going from 54% of the market in 2022, which is the highest recorded, to 33% in 2023. International investors have the lowest share of the market since 2015, where they also accounted for one-third of the transactions. That said, it is also worth mentioning that out of the top 10 largest total buyers in the Danish market in 2023, 4 are Danish actors. Looking at the top 10 largest total sellers, 6 out of 10 companies are Danish. We expect that international transactions will once again account for more than 50% of the transactions in the future when the market really picks up again.”

“Looking at the distribution on a quarterly basis, both residential and industrial/logistics started out with high volumes. As the interest rate level increased over the year, there was a clear decline in volume in all segments except industrial/logistics, which has had a reasonable demand throughout the year. The office segment has been particularly exposed to lower volumes as employers have adjusted their office capacity and the general uncertainty in the market. However, the year ended with some large deals in office and we expect to see more office demand in the future. Historically, Q4 has always carried by far the highest volume, but it was Q1 that had the highest volume in 2023.”