Reindustrialization boosts an otherwise lagging Nordic property market

In Cooperation with EDC Poul Erik Bech, JJL has just published the report Nordic Outlook. The report digs into the Nordic property market across countries and property segments.

Helle Nielsen Ziersen, head of EDC International Poul Erik Bech, says: “2023 was not a very good year for the commercial property market, with buyers and sellers too far apart. However, since the end of 2023, the interest rates have moved in the right direction. It is estimated that the interest rates will stabilize during the year, and the number of transactions will increase. In terms of the return requirements, Denmark has not been hit as hard as our Nordic neighbors, and therefore my expectation is that it will take longer to change the return requirements in Denmark compared to other Nordic countries.”

She continues: “The higher interest rates have also meant that the need for equity has been greater than before, which has been a challenge. There is an expectation that the major central banks will cut interest rates as inflation stabilizes, and this means that the need for capital will decrease in the future.

At the same time, the increased risk appetite among institutional investors should provide a robust basis for reactivating the market. Unlike before, we are experiencing a return-on-investment appetite and there is money in the market, but the risk appetite, new expectations, and stricter requirements from lenders in relation to ESG and green financing have caused investors to adjust their investment profile.

Reindustrialization can create positive growth

Nordic Outlook focuses on reindustrialization, and how it can help promoting the commercial property market. Joseph Alberti, Head of Research, EDC Poul Erik Bech, says:

“Electrification, expansion of industrial areas and Nordic companies moving their operations back home to Scandinavia, are the leading factors for the reindustrialization that is taking place. It can lead to an increasing demand after industrial facilities and buildings for production, warehouse, and logistics.

At the same time, reindustrialization can provide investments in infrastructure to meet the criteria of the increasing industrial activity. We have already experienced an increasing and record high employment in Denmark, which can also lead to an increasing demand for properties. Finally, the proximity of businesses and NATO expansion in Sweden and Finland could potentially also drive demand for commercial property. “

Denmark looks different

“Reindustrialization is increasingly intertwined with sustainable electrification and green energy production initiatives. That process is also expected to have a major impact on the commercial property market, as it has become a key issue for many businesses. ESG and sustainability continue to dominate the entire property market, whether its Denmark or the large industrial areas in the north of Sweden,“ says Joseph Alberti and continues:

“However, it looks a little different in Denmark, if we compare our economy and growth to our Nordic neighbors. In Denmark, the economy is driven by the large pharmaceutical companies, which contribute to growth in the country, while, for example, in Sweden it is more spread out across companies and industries.

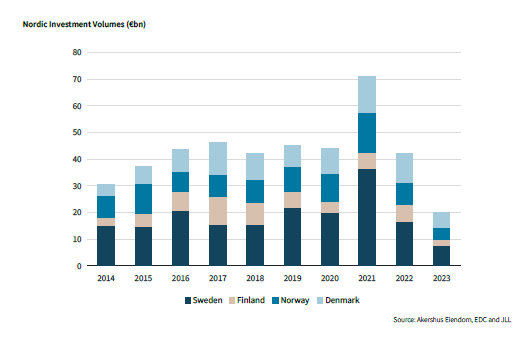

Lowest transaction volume in years

The transaction volume in 2023 did not nearly reach the same level that has characterized the market for the past several years. Compared to 2022, the transaction volume has more than halved and there is still a long way to the level of 2021, where the transaction volume was at its highest. About the large reduction in the transaction volume, Joseph Alberti says:

“The year started off reasonable, but as interest rates rose during the year, there was also a clear drop in transaction volumes for more or less all segments. That pretty much sums up how challenging 2023 has been. Historically, the last quarter of the year tends to be the period with the largest transaction volume, but quite unusually, it was Q1 that carried the majority of transactions in 2023. “

“Traditionally, Sweden accounts for most of the transaction volume in the Nordics. In Denmark, we have experienced the lowest transaction volume since 2014, but it is worth noting that Denmark accounted for the second largest volume in the Nordics in both 2022 and 2023.”

Read the report